How Market Makers Hedge Inventory in Crypto

- Jakob Brezigar

- Updated: February 4, 2026

- Reading time: 7 min

In the world of cryptocurrency, price swings of 20% or more are not bugs, they are features. For the average trader, these fluctuations are a source of anxiety. For a Crypto Market Maker (MM), they are an occupational hazard that must be neutralized.

A common misconception is that market makers survive by predicting the future—guessing which way Bitcoin or Ethereum will move next. But the reality is far more calculated. The best market makers aren’t the best at predicting price; they are the best at managing math.

If a firm holds millions of dollars in assets to facilitate trades, how do they ensure a sudden market crash doesn’t wipe them out?

The answer lies in hedging.

TL;DR

- Market Makers utilize hedging as a critical shield against inventory risk.

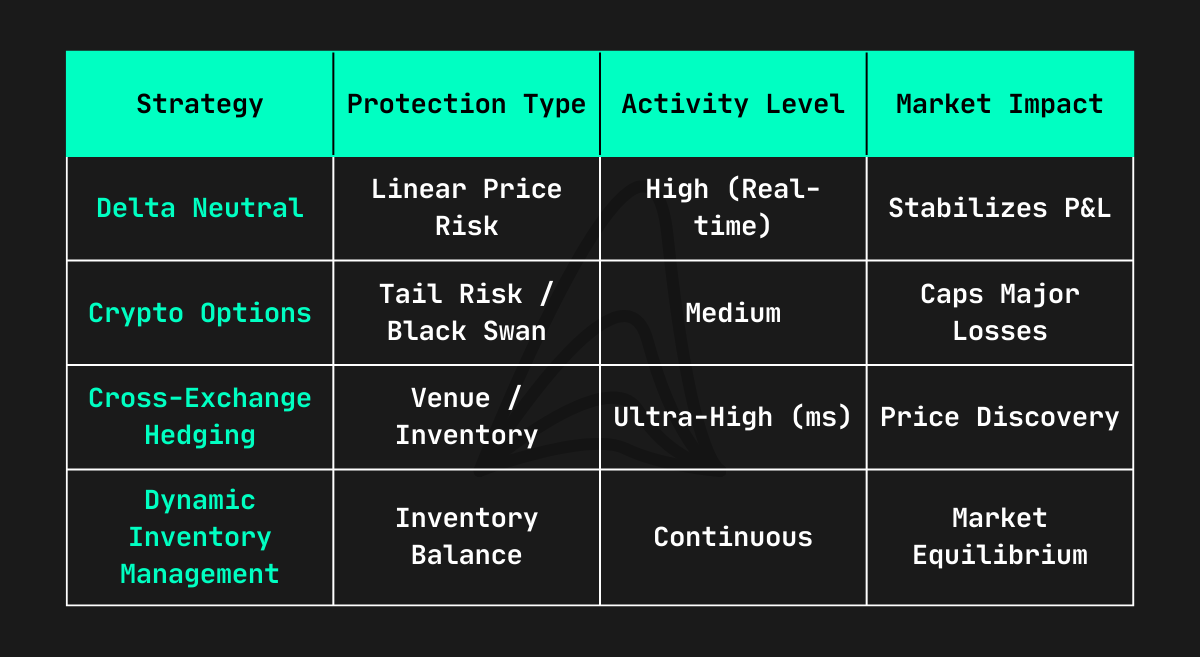

- Strategies like Delta Neutral and Crypto Options neutralize directional price bias.

- Cross-exchange hedging synchronizes liquidity across fragmented CEX and DEX venues.

- Dynamic inventory management automatically adjusts quotes to maintain equilibrium.

- Professional operations prioritize risk mitigation over market speculation to ensure longevity.

At Orcabay, our sophisticated risk management and dynamic hedging strategies allow us to partner with clients for the long term.

By neutralizing directional exposure and mastering inventory risk, we ensure that your market remains resilient even during periods of extreme volatility.

The Problem: Inventory Risk

To understand hedging, you first have to understand the risk. To provide liquidity and ensure you can always buy or sell a token when you want to, market makers must hold massive amounts of assets. This is known as Inventory Risk.

Consider this scenario where a market maker holds a $1 million position to facilitate trading. If that token drops 20% in an afternoon, the firm loses $200,000 on paper. If a market maker operates without a hedge, they aren’t actually making a market. They are gambling.

To solve this, professional MMs employ specific strategies to remain “market neutral” so their profits come from spreads and fees rather than lucky bets on market direction.

Best Hedging Strategies for Crypto Market Makers

Effective market making service requires more than just providing liquidity; it requires mastering inventory risk management. To ensure compressed spreads and robust depth, a market maker must maintain significant asset positions, leaving them vulnerable to sudden price swings.

Without a dynamic hedging framework, a market maker is no longer providing a service; they are simply taking a directional gamble on their inventory. Professional market makers solve this by utilizing two-sided quotes and sophisticated offsets to remain market neutral, ensuring that tight execution is driven by technical precision rather than market speculation.

Below are the four most common hedging strategies used by market makers.

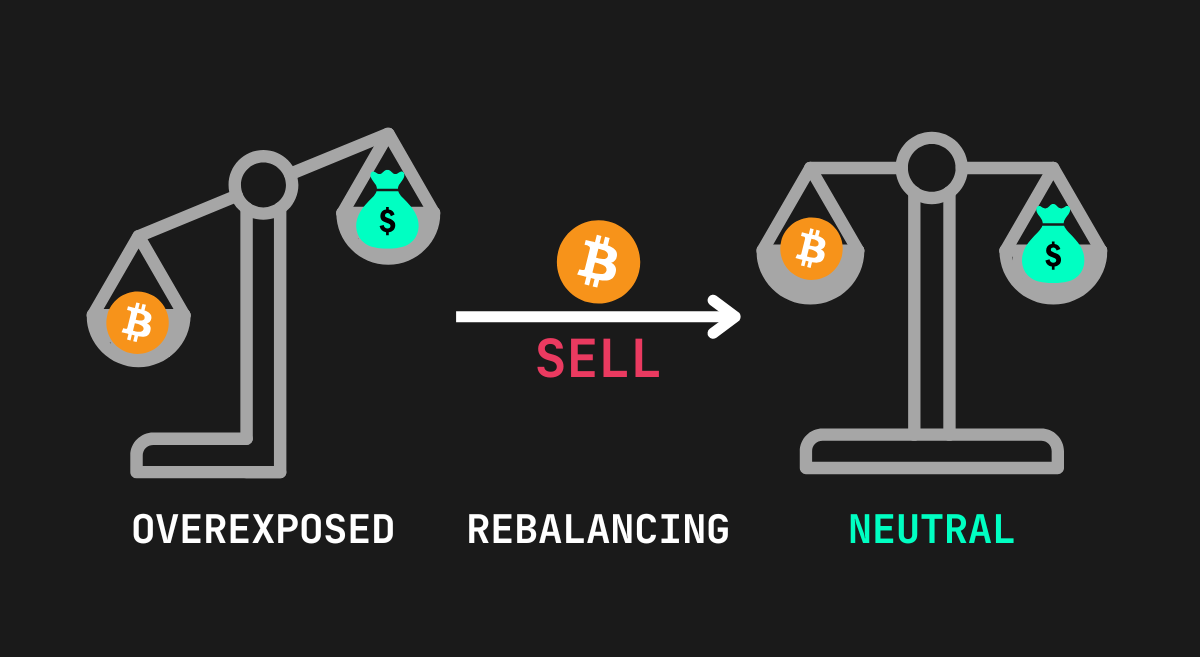

1. Delta Neutral

This is the foundational strategy for risk management. The concept is simple: if a market maker buys an asset, they immediately take an opposing position to bring their “Delta” or price exposure to zero.

• How it works: If an MM buys 100 BTC from a seller to provide liquidity, they immediately open an equivalent short position, often in the futures market.

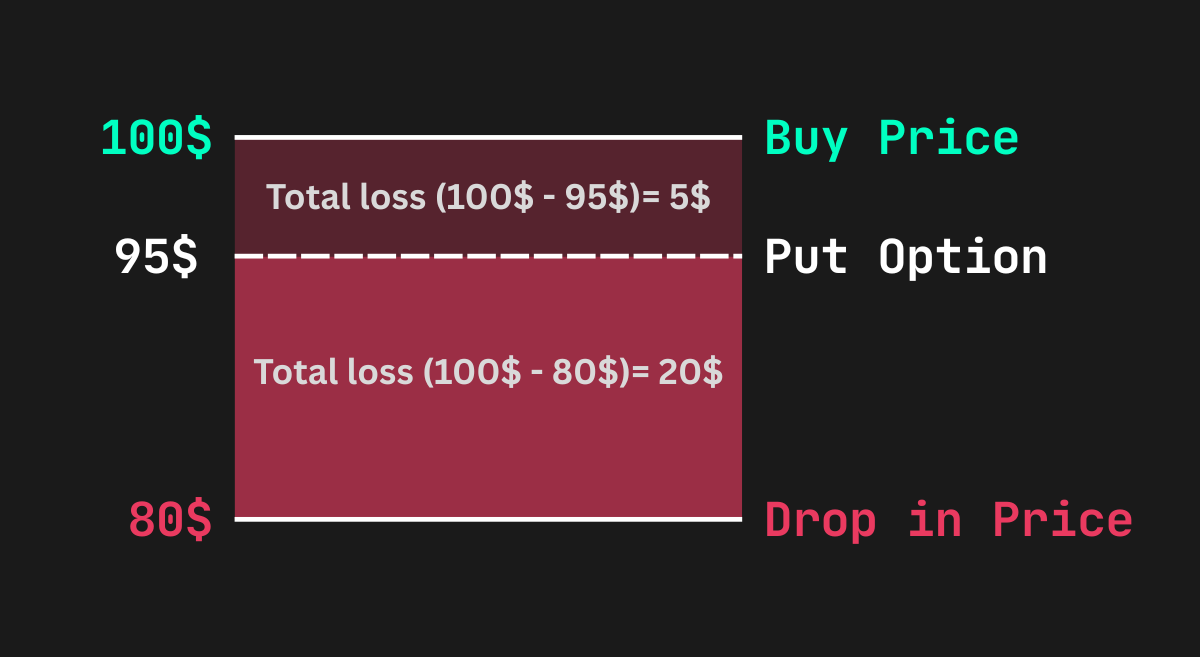

2. Crypto Options

While delta neutral strategies handle linear moves, crypto options provide a sophisticated safety net for high volatility environments. Options allow market makers to cap their potential losses at a fixed amount.

• How it works: Imagine a market maker holds inventory bought at $100. They might purchase a “Put Option” at $95.

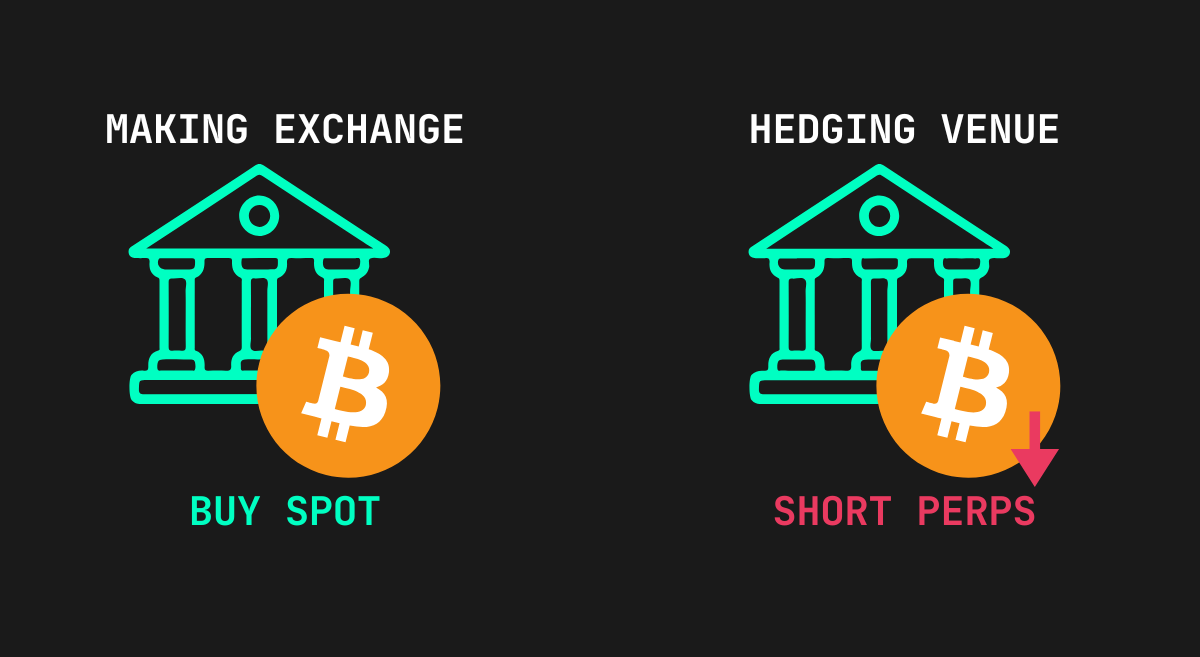

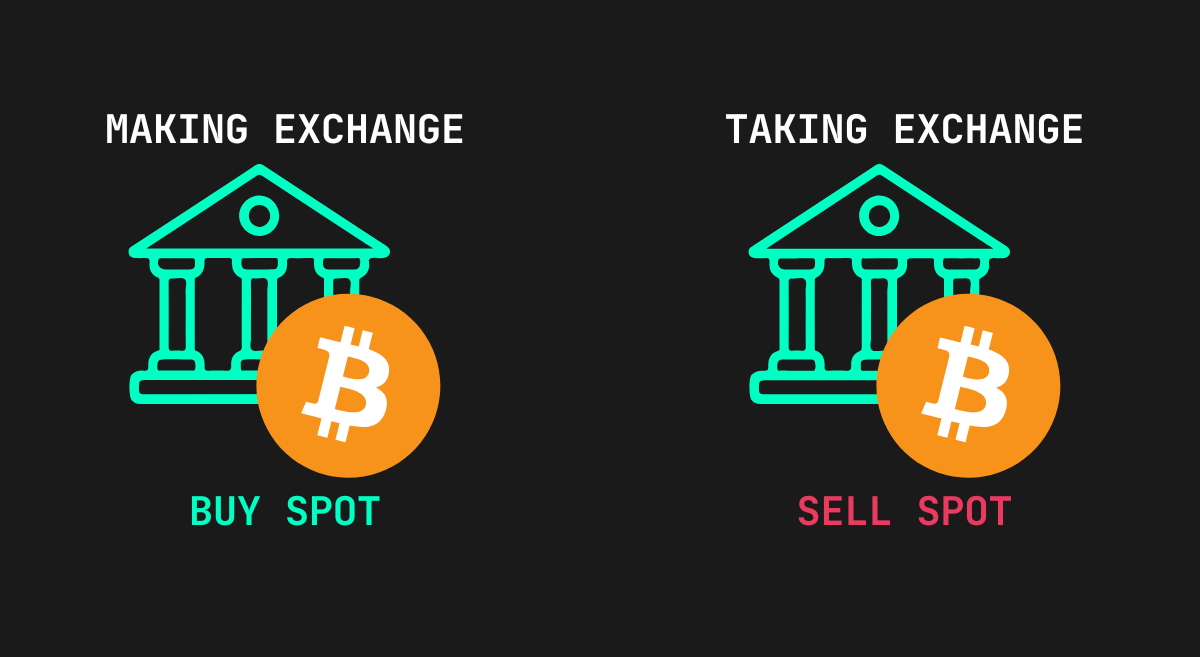

3. Cross Exchange Hedging (Liquidity Mirroring)

Cryptocurrency liquidity is fragmented across dozens of exchanges. Market makers turn this into an advantage through cross exchange hedging, also known as liquidity mirroring or arbitrage.

• How it works: A market maker provides buy liquidity on a smaller, less liquid exchange (the “maker” venue). As soon as an order is filled there, they immediately sell the same amount on a larger, highly liquid exchange (the “taker” venue) at market price.

4. Dynamic Inventory Management

Technical Challenges of Hedging

While the concepts and strategies are straightforward, execution is a high-stakes engineering feat. Implementing these strategies requires a market maker to overcome several critical technical hurdles:

Latency & Execution Speed: In the digital asset space, milliseconds determine profitability. Hedging trades must be executed with near-instant precision to mitigate adverse selection and avoid the value erosion caused by toxic flow.

Market Fragmentation: To maintain robust depth, liquidity must be managed across a disjointed landscape of centralized and decentralized venues. This requires sophisticated cross-exchange synchronization to track and offset inventory in real-time.

Cost Efficiency & Margin Compression: High transaction fees, gas costs, and exchange commissions can quickly overwhelm the thin margins generated by tight spreads. A professional market making [Hyperlink] operation must optimize its hedging frequency to balance risk coverage against operational overhead.

Infrastructure Resilience: Managing inventory risk requires 24/7 system integrity. Hedging engines must be engineered to withstand API outages, exchange downtime, and high-volatility “flash crashes” without losing synchronization.

Conclusion

A provider’s ability to neutralize directional exposure and manage inventory risk is what ensures they remain a stabilizing force during periods of extreme volatility. Ultimately, firms that prioritize advanced hedging are better equipped to foster sustainable, high-quality trading activity and maintain the deep, resilient order books necessary for a thriving market.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial, investment, or other professional advice. All opinions expressed herein are solely those of the author and do not represent the views or opinions of any entity with which the author may be associated. Investing in financial markets involves risk, including the potential loss of principal. Readers should perform their own research and consult with a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results.

Jakob Brezigar

Jakob, an experienced specialist in the field of cryptocurrency market making, boasts an extensive international presence. With Orcabay, he has skillfully managed major operations and deals for a wide array of global stakeholders.