- Jakob Brezigar

- Updated: September 29, 2025

- Reading time: 6 min

Aster vs Hyperliquid: The DEX Wars

Aster took crypto by storm, rising from a merger project to one of the fastest-growing decentralized exchanges in the market. Its explosive volumes, aggressive multi-chain expansion, and backing from major players have quickly put it in the spotlight. In just weeks, it has gone from a new entrant to Hyperliquid’s most serious challenger in the perpetual DEX arena.

But the question remains – can Aster overthrow Hyperliquid as the leading perpetual DEX?

The Beginnings

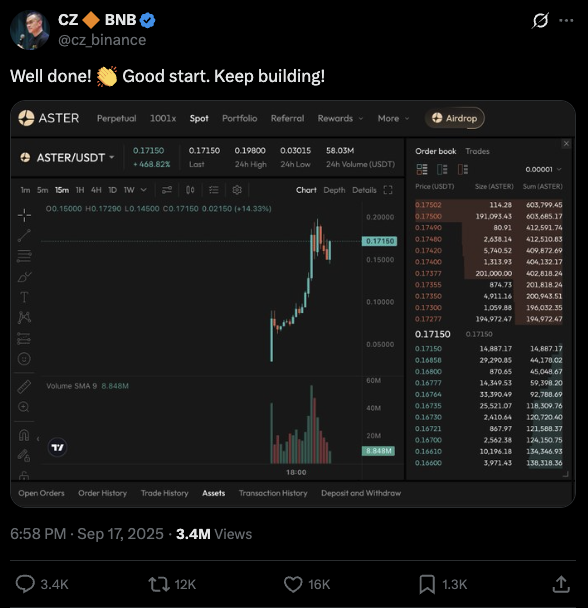

Born from the merger of Astherus and APX Finance, Aster is a decentralized exchange (DEX) focused on perpetual and spot trading. It combines institutional-grade tools with accessibility across multiple blockchains — including BNB Chain, Ethereum, Solana, and Arbitrum. On September 17, Binance’s CZ tweeted a chart of $ASTER with the caption “Well done… Keep building” — instantly fueling attention and speculation. With long-term backing from YZi Labs (formerly Binance Labs), Aster is quickly positioning itself as one of the most serious contenders in the decentralized trading wars.

So why did Aster emerge at this exact moment?

- Perp DEXs found the perfect product-market fit in DeFi.

- Binance and other CEX giants saw new players like Hyperliquid as potential threats.

- Big CEXs wanted to secure their share of the growing decentralized futures market.

Source: X

Hyperliquid vs Aster: Head-to-Head

Category | Aster | Hyperliquid |

Architecture & Chain | Multi-chain perp DEX, launched on BNB Chain, expanding to other ecosystems (Ethereum, Solana, Arbitrum, etc.) | Custom Layer-1 built for trading (HyperCore + HyperEVM), sub-second finality with HyperBFT consensus |

Order Book Model | Central Limit Order Book (CLOB) with cross-chain routing, supports hidden orders for privacy | Fully on-chain CLOB native to Hyperliquid L1; all matching, margin, and settlement occur on-chain |

Leverage Offered | Up to 1001× (in “Simple Mode”) | More conservative — up to ~50× depending on the market |

Hidden / Privacy Orders | Supports invisible / hidden orders (size & direction not publicly visible) | Transparent order book, no hidden orders |

Collateral | Yield-bearing collateral (e.g., asBNB, USDF) so margin earns yield while trading | Collateral through Hyperliquid Liquidity Pool (HLP) vaults; focus on efficiency and depth rather than yield-bearing margin |

Numbers & Stats

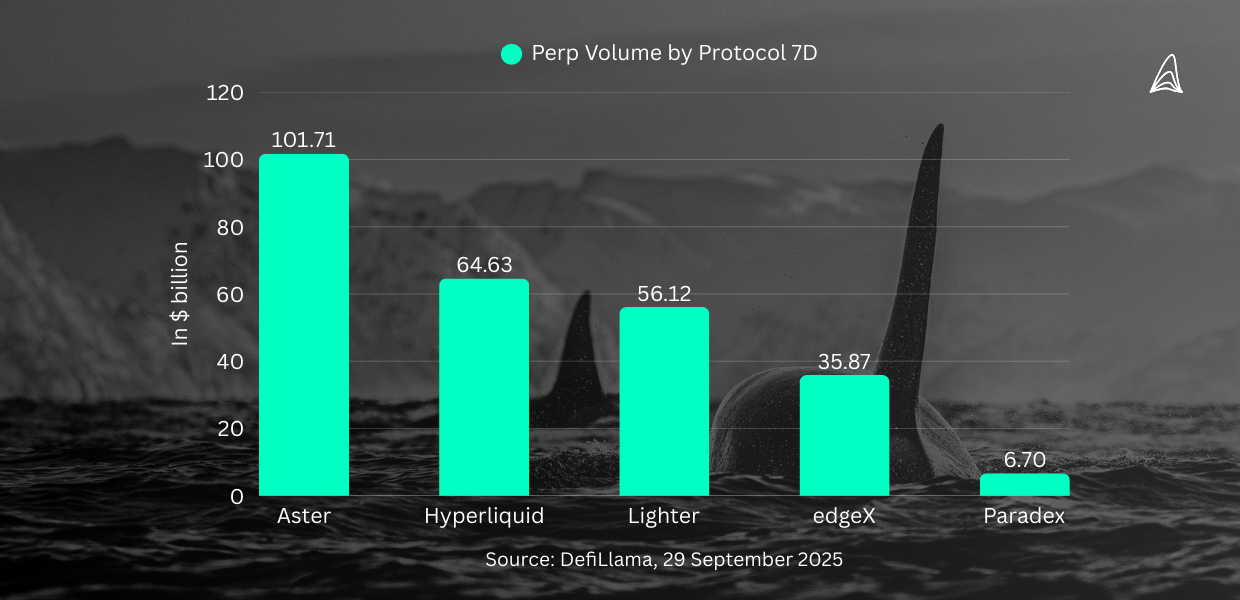

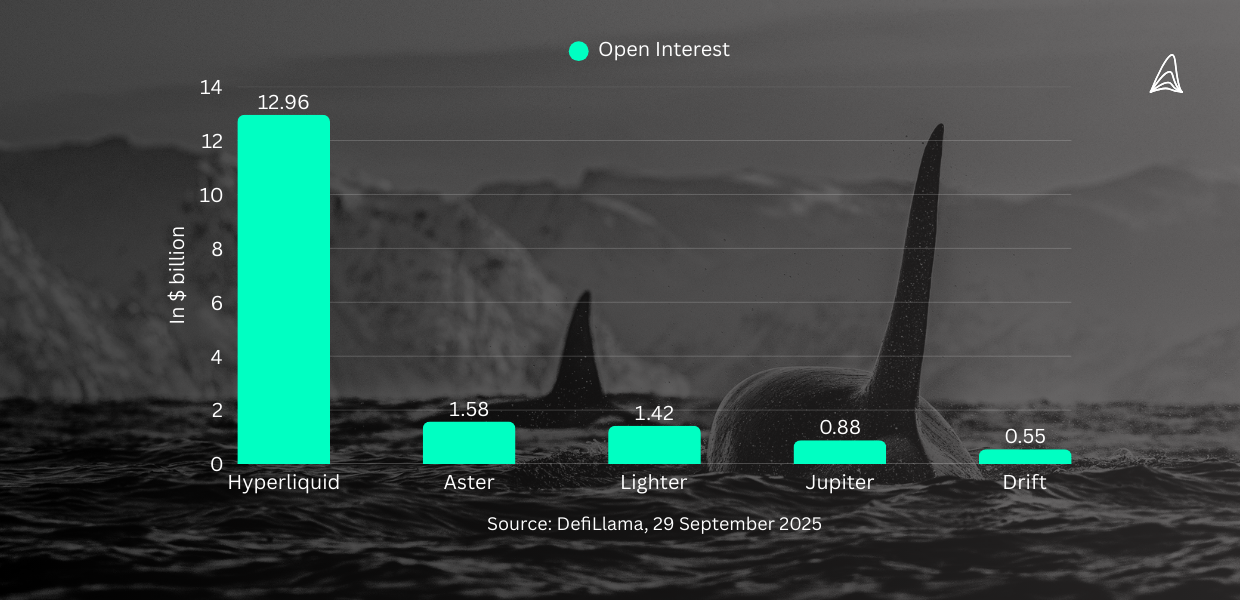

The data highlights how Aster and Hyperliquid are battling for dominance in different arenas.

As of September 29, 2025:

- Perpetuals Volume (7D): Aster hit $101.71B, while Hyperliquid recorded $64.63B — giving Aster about 1.57x higher weekly trading volume.

- Open Interest (OI): Hyperliquid stands at $12.96B, compared to Aster’s $1.58B — meaning Hyperliquid’s OI is roughly 8.2x larger.

- Total Value Locked (TVL): Hyperliquid controls $5.89B, while Aster holds $2.293B, making Hyperliquid about 2.57x bigger.

The takeaway: Aster is winning the volume race, but Hyperliquid dominates in open interest and TVL, metrics that often signal deeper liquidity and stronger long-term positioning.

Pros & Cons

Hyperliquid

Hyperliquid built its own Layer 1 blockchain, independent of Ethereum and other chains — an end-to-end ecosystem designed purely for trading.

Pros:

- CEX-like speeds with on-chain execution

- Unified execution, settlement, and data for a tight, efficient UX

- Strong internal control with fewer external dependencies

- HyperEVM: An Ethereum-compatible environment on Hyperliquid’s chain, enabling developers to deploy EVM-based smart contracts directly while benefiting from Hyperliquid’s speed and liquidity

- Builder Codes: Referral-style system that rewards both traders and ecosystem builders, helping bootstrap growth and align incentives

- HIP-3: Decentralizes the perpetual listing process, allowing community-driven asset listings and reducing centralized control over market expansion

Cons:

- A closed ecosystem, slower to attract outside developers

- Limited extensibility beyond its trading focus

- Criticism for over-centralization: Despite its decentralized branding, Hyperliquid has faced scrutiny for relying on a small validator set, raising concerns that too much control could rest in the hands of a few parties

Aster

Aster took the opposite approach, embracing multi-chain integration across Ethereum, BNB, Solana, and Arbitrum.

Pros:

- Openness and lower barriers for diverse users

- Cross-chain liquidity scheduling

- High compatibility with existing DeFi tools

- Extreme leverage offerings, with equity perps up to 1001x

Cons:

- Higher technical complexity (bridge risks, latency, MEV defense)

- A newer project still in hyper-growth mode with its moat forming

- Extreme leverage polarizes opinions — some see it as innovative, others as reckless “casino logic”

Tokenomics: HYPE vs ASTER

Hyperliquid (HYPE)

- Max Supply: 1B

- Circulating: 270.77M (27.08%)

- Vested / Unlocked: 310.10M (31.01%)

- Next Unlock: November 29, 2025 — 214,199 HYPE (0.02% of total supply)

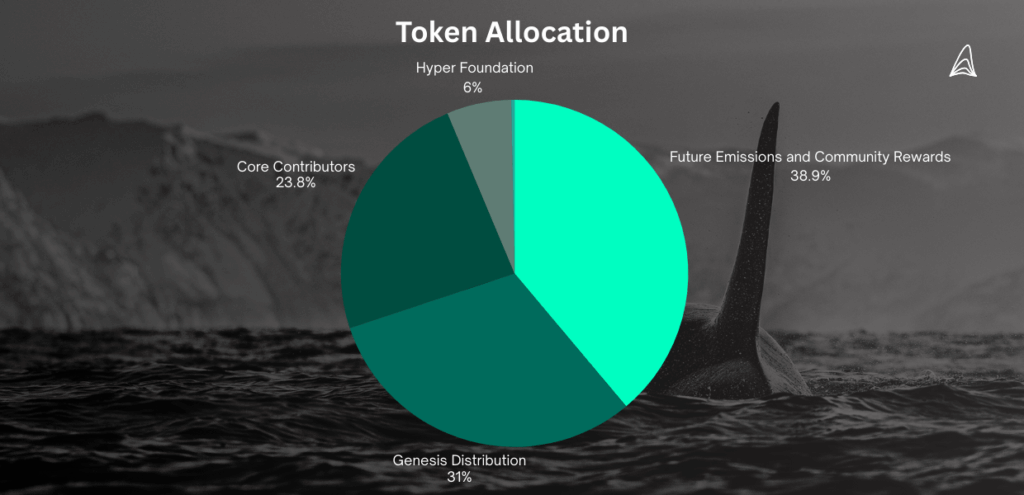

Token Allocation

- Future Emissions and Community Rewards: 38.888%

- Genesis Distribution: 31.0%

- Current and Future Core Contributors: 23.8%

- Hyper Foundation Budget: 6.0%

- Community Grants: 0.3%

- HIP-2: 0.012%

Source: DropsTab

Aster (ASTER)

- Max Supply: 8B

- Circulating: 1.66B (20.72%)

- Vested / Unlocked: 1.65B (20.68%)

- Next Unlock: October 17, 2025 — 183.13M (2.29% of total supply)

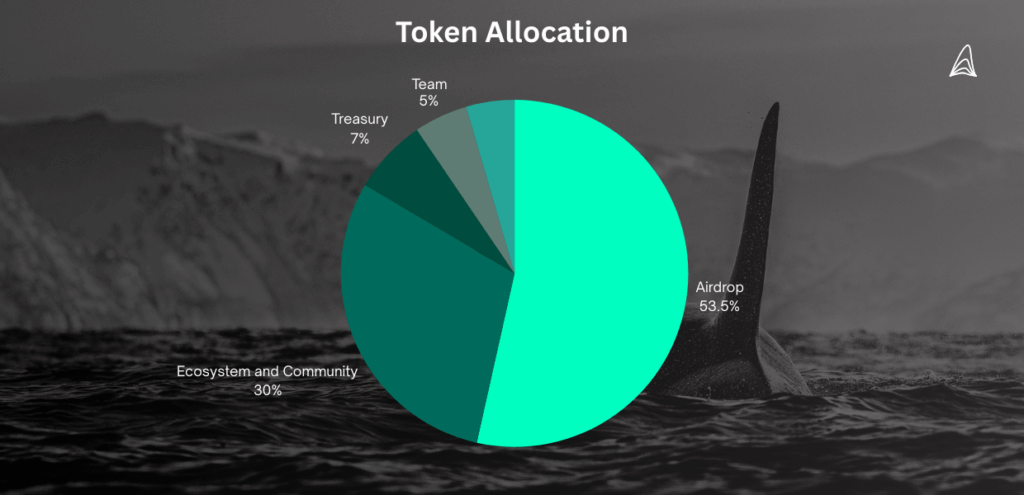

Token Allocation

- Airdrop: 53.5%

- Ecosystem & Community: 30.0%

Treasury: 7.0% - Team: 5.0%

- Liquidity & Listings: 4.5%

Source: DropsTab

Hyperliquid’s HYPE token is positioned like equity. With $1B+ annual fee revenue, the team buys back and burns HYPE, creating a deflationary, dividend-like model. This makes it attractive to institutions and value-oriented investors.

Aster’s ASTER token is designed as a community-first experiment. Out of its 8B total supply, 53.5% is allocated to community incentives, governance, and liquidity programs. This favors broad participation and fast network effects over pure scarcity.

Trade-offs:

- HYPE: Stable, revenue-backed, institution-friendly — but less decentralized in spirit.

- ASTER: High community engagement and retail buzz — but more volatile and speculative.

In practice, Hyperliquid attracts steady institutional money, while Aster captures retail enthusiasm and viral growth.

Conclusion & Future Direction

Perpetual DEXs have reshaped the crypto landscape, and Aster’s rapid rise has injected new momentum into the sector. It represents both a CEX giant’s counterpunch and a fresh DeFi narrative. Still, for both Hyperliquid and Aster, long-term value will be decided by real user demand and sustainable business models.

- Hyperliquid: Own chain + high performance + steady token model → Institutional and professional traders.

- Aster: Multi-chain + extreme leverage + community-driven flywheel → Retail adoption and narrative blitz.

This clash reflects a broader fork in DeFi’s future: closed & optimized ecosystems vs. open & multi-chain networks, steady institutional growth vs. high-risk retail expansion.

As always, before committing to any trading venue — DYOR.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial, investment, or other professional advice. All opinions expressed herein are solely those of the author and do not represent the views or opinions of any entity with which the author may be associated. Investing in financial markets involves risk, including the potential loss of principal. Readers should perform their own research and consult with a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results.

Jakob Brezigar

Jakob, an experienced specialist in the field of cryptocurrency market making, boasts an extensive international presence. With Orcabay, he has skillfully managed major operations and deals for a wide array of global stakeholders.