- Sebastjan Bele

- Updated: November 6, 2025

- Reading time: 6 min

Bitcoin Dips Below $100K as $2B Liquidations Shake the Market

The crypto market saw a sharp correction early in the week, with Bitcoin dropping from $110K to below $100K for the first time in over four months before rebounding to $103K. Ethereum fell from $4K to $3K and has since recovered to $3,400. On Tuesday, November 4, daily liquidations topped $2 billion, raising questions over whether this was a healthy correction or the start of a broader downturn.

In other news, Wintermute’s Evgeny Gaevoy clarified the firm isn’t suing Binance and never planned to, while Robinhood’s Q3 trading revenue jumped 129% YoY, driven primarily by crypto trading. Monad set November 24 as the launch date for its Layer 1 blockchain and native token, and Ripple raised $500 million at a $40 billion valuation in a round led by Fortress and Citadel. Meanwhile, Bitcoin and Ethereum ETFs recorded $800 million in outflows, reflecting rising investor caution amid growing market fear.

News

- Bitcoin Teeters Near $100,000 as Ether Turns Negative for the Year Amid Crypto Pullback

- Crypto Liquidations Top $2 Billion as Bitcoin Slides and Ethereum Hits Four-Month Low

- Ripple Raises $500 Million at $40 Billion Valuation in Round Led by Fortress and Citadel

- Wintermute’s Evgeny Gaevoy Says the Market Maker Isn’t Suing Binance and ‘Never Had Plans To’

- Robinhood Q3 Trading Revenue Jumps 129% YoY, Driven by Cryptocurrency Revenue

- Bitcoin and Ethereum ETFs Shed $2.6 Billion in Assets Over the Past Week

- White House Says Trump’s Pardon of CZ Was Reviewed ‘With Utmost Seriousness’

- Gemini Launches Prediction Market Contracts

- Metaplanet Borrows $100 Million Against Bitcoin Holdings to Buy More BTC

- S&P Digital Markets 50 Index Gains Blockchain Verifiability via Chainlink

Table of Contents

Markets

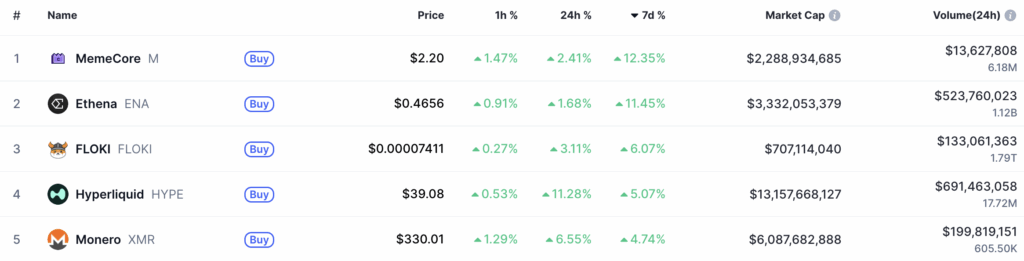

Best Performers

Privacy coins are leading the market, as the ongoing narrative around on-chain privacy and censorship resistance continues to gain traction. The strong performance of Zcash (ZEC) has created a spillover effect across the broader privacy sector.

Decred (DCR) topped the list with a +150% weekly gain, followed by Dash (DASH) up +140%, and ZKsync (ZK) up +121%, reflecting renewed optimism around privacy-focused and zk-driven ecosystems. Internet Computer (ICP) and Zcash (ZEC) also saw solid moves, climbing +105% and +44% respectively.

Sector Performance

According to GMCI, the GMCI 30, which tracks the top 30 cryptocurrencies, is down 12.26% over the past week. The GMCI Mid Cap is down 11.92%, while GMCI Small Cap indices posted a loss of 8.92%. The rest of the sectors over the past week:

- Layer 1: -14.59%

- Layer 2: -13.63%

- DeFi: -17.73%

- AI: -12.66%

- RWA: –18.66%

- Gaming: -19.21%

- Meme: –15.70%

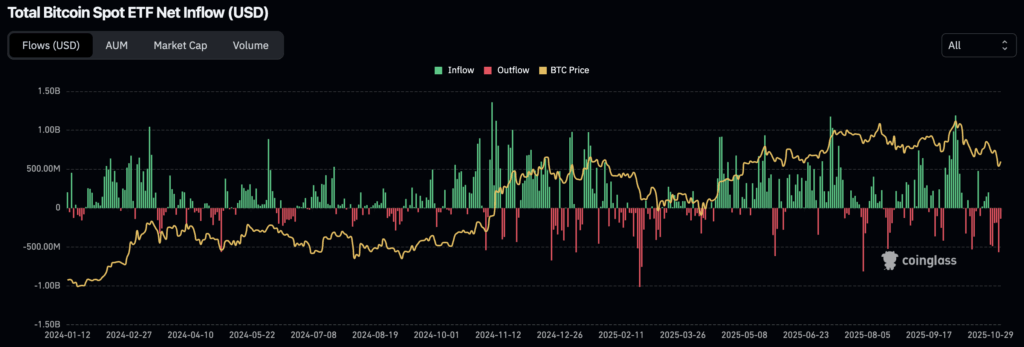

US Spot ETF Balances

US Bitcoin Spot ETFs

Total Assets Under Management (AUM) = $140.15Billion

Weekly Inflows = -$14.37 Billion

US Ethereum Spot ETFs

Total Assets Under Management (AUM) = $19.56 Billion

Weekly Inflows = -$3.81 Billion

*The data for BTC / ETH ETFs can vary, so we use Coinglass as our source.

Market Commentary

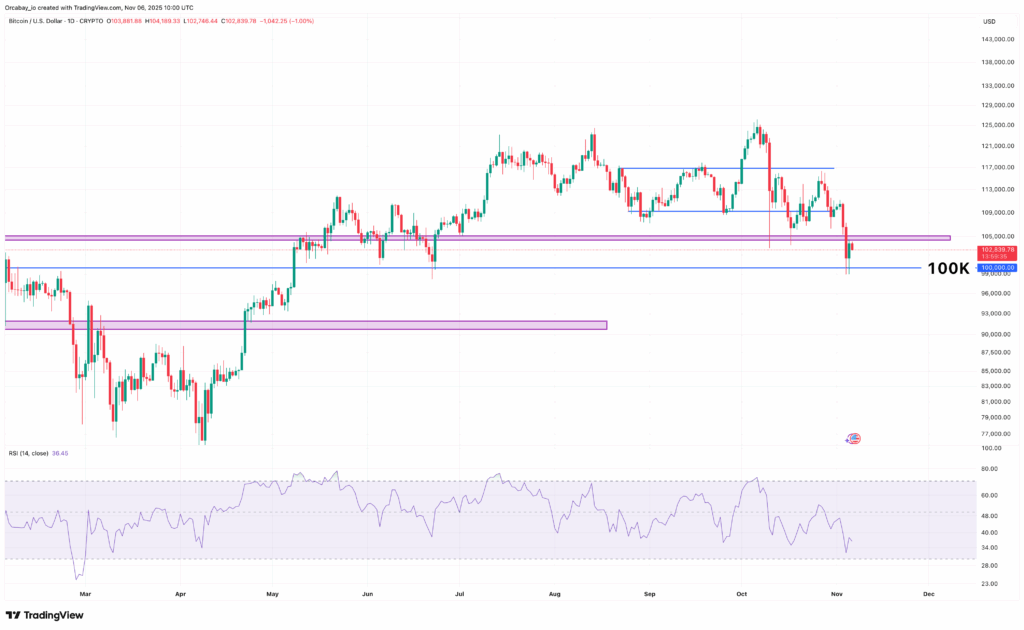

Bitcoin

$BTC broke down from its previous range, dipping aggressively below $100K, which for now has held as support. The bounce to $104K was short-lived, as resistance proved too strong to sustain upward momentum.

At this stage, the market is in wait-and-see mode. We won’t lie, the setup doesn’t look great, and all eyes are now on whether the $100K level can hold as support. Time will tell if this was just a deeper correction or the early signs of a broader bearish shift.

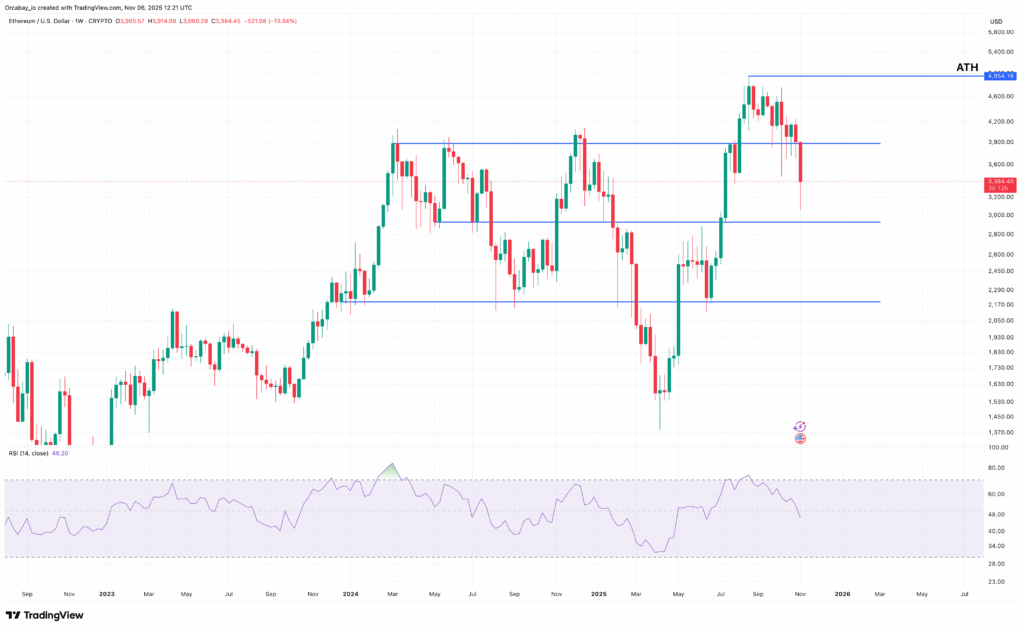

Ethereum

$ETH

support around $3,800 failed to hold, sending the price down to near $3,000 before it rebounded modestly. Similar to Bitcoin, the current setup looks fragile, with ETH dangling in the middle of the range and lacking clear direction.

If $3,000 gets tested again, it’s crucial that it holds to maintain any chance of a push higher. For now, caution is advised, as market sentiment remains uncertain and volatility elevated.

Bitcoin dominance is up to 59.9%, indicating a modest rotation back into BTC.

In traditional markets:

- S&P 500 down 0.43%

- NASDAQ down 0.51%

- Gold down 0.44%

The total crypto market cap stands at $3.42T, down ~8.1% from $3.72T, reflecting the impact of this week’s sharp correction. The Fear & Greed Index currently reads 27 (Fear) but briefly dipped into Extreme Fear in recent days.

What's Next?

Global liquidity continues to expand, but the main challenge for crypto remains the lack of fresh inflows — current capital is largely recycling within the ecosystem. This has made rallies short-lived and explains why market breadth has narrowed over the past months.

In this cycle, three key forces have driven growth: stablecoins, Digital Asset Treasuries (DATs), and ETFs. Since early 2024, the combined value of DATs and ETFs has surged from around $40 billion to $270 billion, while stablecoins doubled from ~$140 billion to ~$290 billion. This reflects strong structural expansion but also signals a plateau in new liquidity inflows.

With the U.S. government shutdown, economic data releases such as CPI and jobs reports may be delayed, increasing market uncertainty. The spending freeze adds additional pressure on both crypto and traditional finance. Meanwhile, Polymarket odds still price a 67% chance of a 25 bps Fed rate cut in December — a move that could ease demand for T-bills and redirect liquidity toward risk-on assets, including crypto.

Overall, macro conditions remain supportive: equities sit at all-time highs, liquidity is available, rate cuts are likely, and quantitative tightening has ended. Now, the key is whether this liquidity begins flowing back into crypto, setting up the next leg of the cycle.

Meme of the Week

We hope you enjoyed this week’s edition of Diary of a Market Maker! Stay tuned for more insights, updates, and market-moving highlights as we continue to keep you informed and entertained in the ever-evolving world of crypto.

In the meantime, follow us on LinkedIn and X (Twitter) for real-time updates and more!

Until next time, happy trading and stay ahead of the curve!

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial, investment, or other professional advice. All opinions expressed herein are solely those of the author and do not represent the views or opinions of any entity with which the author may be associated. Investing in financial markets involves risk, including the potential loss of principal. Readers should perform their own research and consult with a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results.

Jakob Brezigar

Jakob, an experienced specialist in the field of cryptocurrency market making, boasts an extensive international presence. With Orcabay, he has skillfully managed major operations and deals for a wide array of global stakeholders.